Receivable Collection Period Formula

For example lets say a company allows a. Ace Traders offered a credit period of 30 days within which the bill should be paid by Max Enterprises.

Average Collection Period Meaning Formula How To Calculate

Increasing Accounts Payable Turnover Ratio.

. Acid-Test Ratio Formula in Excel With Excel Template Here we will do the same example of the Acid-Test Ratio formula in Excel. Average Collection Period. Average collection period 365Accounts Receivable turnover ratio.

Let us consider the following Days Sales Outstanding example to understand the concept better. Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time generally monthly quarterly or annually divided by two. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short-term investmentsThe current liabilities section typically includes accounts payable accrued expenses and taxes customer deposits and other trade debt.

You can easily calculate the Acid-Test Ratio using Formula in the template provided. For example suppose a company has an accounts receivable collection period of 40 days. DSO can be calculated by dividing the total accounts receivable during a certain time frame by the total net credit sales.

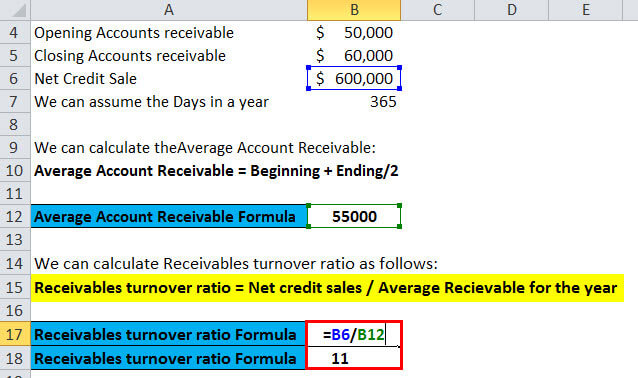

The different important points related to the Average Payment period are as. Accounts receivable aging reports. The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year.

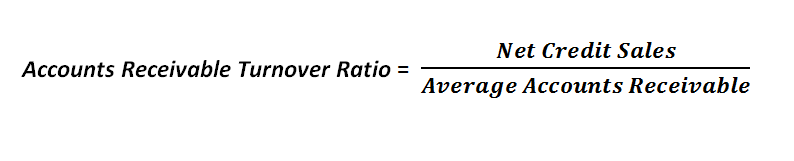

200000 x 1 175000 x 5 100000 x 10 75000 x 15. The accounts receivable turnover ratio formula looks like this. Alternative formula Average collection period Average accounts receivable per dayaverage credit sales per day read more and inventory processing period etc.

Lets talk about how a company calculates its average collection period. The formula looks like the one below. So that is not bad for business.

Also known as cash receipts. The formula for calculating the AR turnover rate for a one-year period looks like this. Average Collection Period 365 Days or 12 Months Debtor Receivable Turnover Ratio For calculation of the receivable turnover ratio you can use our.

DSO is often determined. Compare accounts receivable collection period to the standard number of days customers are allowed before a payment is due. Payment such as cash or a check that you receive from your customers for goods or services.

So to get a better understanding of the companys cash position change in net working capital formula is used. A best practice for businesses is to use an aging report to make an estimate of bad debts for each period. You can enter two types of receipts in Receivables.

It is also known as Days Sales Outstanding. Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable. Accounts Receivable Turnover Days Accounts Receivable Turnover Days Average Collection Period an activity ratio measuring how many days per year averagely needed by a company to collect its receivables.

This is calculated using the following formula. Generally the average collection period is calculated in days. You need to provide the three inputs of ie Current Assets Inventory and Current Liability.

Here are some examples in which an average collection period can affect a business in a positive or negative way. Use the Receipts window to enter new or query existing receipts. That means the company has paid its average accounts payable balance 625 times during that time period.

Here till the date Max Enterprises pays Ace Traders the amount of 100000 will be called as accounts payables and shown as liability towards creditors in the balance sheet. This ratio is calculated as 365 Accounts Receivable Turnover displaystyle 365div textAccounts Receivable Turnover. Some people also choice to include the current portion of long-term debt in the liabilities section.

Formula for Average Collection Period. Net sales is calculated as sales on credit - sales returns - sales allowances. It is very easy and simple.

Days Sales Outstanding Formula. Convert turnover to average collection period. The result represents how many days the average credit sale stays in.

Days sales outstanding DSO is a measure of the average number of days that it takes a company to collect payment after a sale has been made. This number is then multiplied by the number of days in the period of time. Days Sales Outstanding - DSO.

Average Collection Period Formula. The calculation of days sales outstanding DSO involves dividing the accounts receivable balance by the revenue for the period which is then multiplied by 365 days. DSO Accounts ReceivablesNet Credit SalesRevenue 365.

Say that in a one-year time period your company has made 25 million in purchases and finishes the year with an open accounts payable balance of 4 million. This means its accounts receivable is turning over approximately 9 times per year. A formula for Net Working Capital.

25 million 4 million 625. High DSO Inefficient Cash Collection from Credit Sales Less Free Cash Flow Days Sales Outstanding DSO Formula. Accounts Payable is on a companys balance sheet as a current liability and is a collection of short-term credits extended by vendors and creditors for good and services received by a business.

The Days Sales Outstanding formula to calculate the average number of days companies take to collect their outstanding payments is. Against the simplicity of the formula the calculation and practical usability of this formula have. This is change is working capital from one period to another and it is really important to track the changes to monitor operating cash flows.

Smaller businesses typically rely on the quick collection of receivables to make payments for operational expenses such as salaries utilities. Calculate the AR turnover in days. More Resources on Small Business Accounting.

An AP department also takes care of internal payments for business expenses travel and petty cash. Max Enterprises purchased goods worth 100000 from Ace Traders. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable.

Revenue earned from investments interest refunds stock. In other words this indicator measures the efficiency of the firms collaboration with clients and it shows how long on average the companys clients pay. On the face of it this seems beneficial to the.

Average Collection Period Formula Calculator Excel Template

Average Collection Period Definition And Formula Bookstime

Accounts Receivable Collection Period Open Textbooks For Hong Kong

Average Collection Period Formula And Calculator Excel Template

Comments

Post a Comment